Do you fully understand investment risk?

Most investors think of risk in terms of their age. Older investors should be low risk takers and young investors should be high risk takers. This way of thinking is not entirely correct. For instance, someone who has not adequately saved for retirement and only has 5 years left to work, may have to adopt a high risk investment profile to try achieve high returns in a short space of time, as opposed to someone who has adequately saved and now wants to protect those gains during their last working years by adopting a lower risk profile.

It makes sense then that risk is more related to the goals of an investor and how much (or little) time the investor has to achieve the goal. (More on risk profiling later after we examine the actual risks that affect investments)

There are 11 types of key risks involved in investing and understanding the basics of each risk is fundamental to successful investing.

- Interest rate risk. Refers to whenever investors invest in products (such as bonds, or fixed income) that offer a fixed rate of return, they are exposing themselves to interest rate risk.

- Business risk. Refers to the possibility that the issuer of a security or a bond may go bankrupt or be unable to pay the interest or principal (in the case of bonds or fixed income). A common way to avoid unsystematic risk is to diversify across many asset classes.

- Credit risk. Refers to the possibility that a particular bond or fixed income issuer will not be able to make expected interest rate payments and/or principal repayment. Typically, the higher the credit risk, the higher the interest rate on the bond.

- Taxability risk. Refers to the risk that a security that was issued with tax-exempt status could potentially lose that status prior to maturity resulting in lower after-tax yield than originally planned.

- Call risk. In a declining interest rate environment, investors are usually forced to take on more risk in order to replace the same income stream.

- Inflationary risk. When the value of an asset or income is eroded as inflation shrinks the value of a country’s currency. This is particularly relevant to retirement income.

- Liquidity risk. Liquidity risk refers to the possibility that an investor may not be able to buy or sell an investment as and when desired. A good example of liquidity risk is selling real estate. In most cases, it will be difficult to sell a property at any given moment should the need arise, unlike investing in a listed security which can be liquidated daily.

- Market risk. Refers to a risk that will affect all securities in the same manner. In other words, it is caused by some factor that cannot be controlled by diversification.

- Reinvestment risk. It is the risk that falling interest rates will lead to a decline in cash flow from an investment when its principal and interest payments are reinvested at lower rates.

- Social, political & legislative risk. Risk associated with the possibility of nationalization, unfavourable government action or social changes resulting in a loss of value.

- Currency (exchange rate) risk. Currency or exchange rate risk is a form of risk that arises from the change in price of one currency against another. Currency risk is greater for shorter term investments, which do not have time to level off like longer term foreign investments.

The importance of financial advice when determining risk

You can clearly see from the above, that acquiring the services of a registered and competent financial adviser is crucial when planning how to invest over one’s life. A competent adviser will construct various strategies for various times in your life, by taking all the key risk factors into account. Each annual review with your advisor will determine the next steps based on current events and how to avoid the negative ones and exploit the positive ones.This is where risk profiling becomes important. Risk profiling is determined by the investment term one has to choose to achieve a certain investment goal.

| Risk profile | Time horizon (years) |

| Low | 1 – 3 |

| Medium-Low | 3 – 6 |

| Medium | 6 – 8 |

| Medium-High | 8 – 11 |

| High | 11+ |

Investors who want to avoid risk will seek shorter term products that provide certainty such as money markets and bonds/fixed income, as opposed to investors who are prepared to embrace risk because of the potential rewards that investing in property and shares offer.

The only way to smooth out uncertainty (higher risk) is to add more time. Time is the ultimate smoother of risk. You can see by all of the above that even choosing a perceived “low risk” product like a money market fund or a bond, can be upturned by sudden political, inflationary or currency risk, where as a perceived “high risk” product like property or shares are not immediately affected by the aforementioned risks because there is more time for these risks to potentially normalise.

What does this all mean?

It means that advisers and investors should focus on the investment goal first, then determine the amount of time one is prepared to wait for the goal to materialise and only then choose products are designed to avoid, or exploit certain risks to deliver the investment goal.

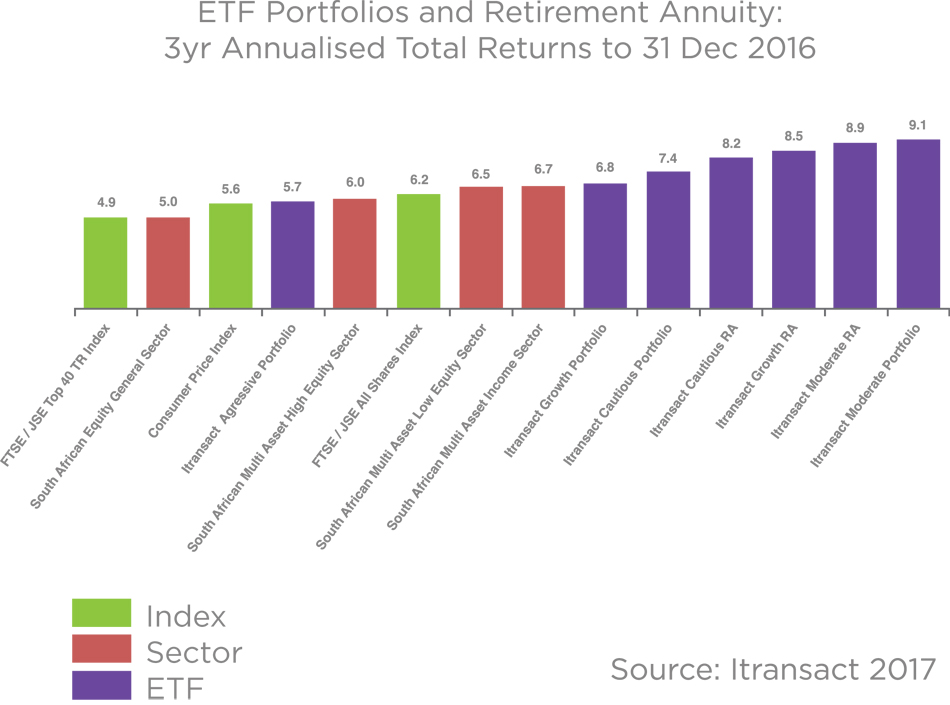

Itransact offer investors and financial advisors a range of low cost Exchange Traded Fund (ETF) goal orientated risk adjusted investment portfolios for general saving and retirement planning purposes.