Paying yourself after retirement

People forget that they need to pay themselves after retirement

Consider the table below.

| Age | Number of months left to save for retirement | Number of months left to pay oneself during retirement |

| 20 | 540 | 240 |

| 30 | 420 | 240 |

| 40 | 300 | 240 |

| 50 | 180 | 240 |

| 60 | 60 | 240 |

Source: Itransact. Assumptions: Average retirement age 65, average mortality age 85

The table highlights the fact that most people do not realise how many months they need to pay themselves. This one of the main reasons why only 6% of South Africans are able to maintain their standard of living at retirement. So what happened to the rest?

South Africans don’t have a savings culture

According to a recent World Bank report, 86% of gainfully employed South Africans have debt and mostly service debt only, rather than servicing both debt and savings. The report underlines that most developing African economies yield the same results (Kenya at 79%, Niger at 71%, Botswana at 69% and Zimbabwe at 62%)

Consider this. Someone starting their career have no issue with buying a car (thus incurring debt) since they have physical possession of the asset. For them, retirement is a far away inanimate concept of no apparent or current value.

How does one change this behaviour? Creating a savings culture through financial advice and planning is a key driver of creating such a culture. It can highlight the importance of your client understanding critical issues like how many pay days they have left to save for retirement. Telling a 20 year old they have 45 years to save for retirement may not interest them. Showing them that they only have 540 pay days left to effectively self-finance the next 240 paydays during their retirement years might just.

Good planning

In the end, it’s about providing your client with good, well thought out, easy to understand plan. Basic elements such as implementing a proper budget to ensure they don’t spend more than they earn. One that helps them plan to pay off their debt (the first form of saving) whilst gradually implementing a retirement savings plan.

Don’t let the cost of investing cost your clients their retirement

A good retirement savings plan relies on keeping investment costs low. Passively managed multi asset Exchange Traded Fund (ETF) personal retirement portfolios can consistently deliver market returns at the lowest possible cost. Regrettably, only a handful of investment platforms offer this type of Investment and even fewer have the track record or experience.

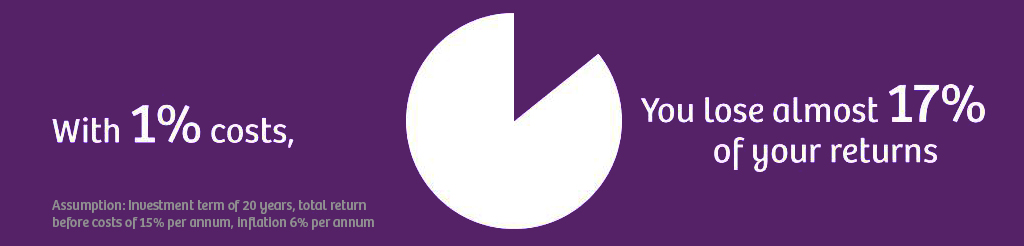

The illustrations below show how costs destroy returns.

Source: Itransact. Assumptions Investment term of 20 years, total return before costs of 15% per annum, inflation of 6% per annum.

The cost of avoiding financial advice can be catastrophic

Many of your clients may say that financial advice is expensive. Pages of research show that only 6% of South Africans are able to retire comfortably. The research suggests that those who are not part of the fortunate 6%, but were gainfully employed during their working lives, failed to retire comfortably due to poor planning on their part with little or no financial advice.

Conclusion

Paying for good financial advice can make a difference between retiring comfortably or not.